Baron Accounting Can Be Fun For Everyone

Table of ContentsExcitement About Baron AccountingBaron Accounting Things To Know Before You Get ThisFacts About Baron Accounting RevealedTop Guidelines Of Baron AccountingThe Baron Accounting PDFs

Seeking assistance from an accounting professional is a wise financial investment for any service. Accounting professionals are specialists in taxes and can aid you save cash and time. If you have an accounting professional at hand, you can gain from customised economic guidance, tax obligation planning, and guidance during tax audits. In addition to this, they use year-round assistance and make certain that you remain compliant, while they handle tax audit and declaring.They aid with the prep work of pay-roll income tax return, lodgment of service task declarations, edge advantages tax obligation returns, little service CGT concessions and far more. The blog lays out the relevance of looking for assistance from a professional accountant for a firm. The prior factors will aid you understand the significance of a tax accounting professional in a business.

Whether you are an individual struggling to load out your tax return, or maybe a local business owner drowning in documents every tax obligation period, employing a specialist tax obligation preparation service is something that will make your life a lot less complicated. The advantages of employing a tax professional consist of not only time cost savings and decreased stress, but financial benefits too.

(https://www.startus.cc/company/bareunhoegyebeobin-i-baron-accounting)Numerous people find that dedicating a number of hours to declaring taxes simply does not make sense and select to save cash and time by employing a specialist. Tax obligations are something you do not have to deal with alone.

The Main Principles Of Baron Accounting

Lots of people do not consider employing specialist solutions just due to the price. The fact is frequently just the contrary. If a tax expert can discover reductions or tax credit scores that you might have missed out on or probably really did not learn about, the savings can exceed the charge it costs to have them prepare your tax return.

Did you adhere to the tax obligation code to the letter in previous years? Did you miss a prospective tax obligation credit report? These are concerns that tax obligation professionals can explore for you and modify if necessary. Appropriate tax filing is an excellent beginning to staying clear of a tax obligation audit. Nonetheless, in the event that you are examined, specialists who offer internal revenue service tax audit services can aid you accomplish the very best feasible end result.

Rumored Buzz on Baron Accounting

Ensure that your tax obligation preparer offers e-file tax returns. Ensure that your tax preparer will certainly authorize their name and give their PTIN on your tax obligation return. Your tax professional has to be able to reply to the IRS. Experts that my review here have a PTIN and are enlisted agents, CPAs, or attorneys can represent you when it pertains to internal revenue service audits, settlements, and collection concerns.

If you experience inconveniences while tax declaring and want experts to service it, you must know the functions included in tax accounting. It will certainly aid you to get the best sources for it. While filing taxes there is a requirement to take into consideration different facets connected to the taxes according to the standards.

Facts About Baron Accounting Uncovered

Tax obligation accountants make certain compliance with tax laws and laws, assisting clients prevent fines and lawful issues connected with non-compliance. Tax obligation accountants assist clients keep organized financial documents to support their tax returns and defend versus possible audits.

Tax accounting professionals offer calculated recommendations on economic choices to decrease tax obligation ramifications. These tools aid services in browsing the detailed and ever-changing realm of tax obligation laws, decreasing tax obligation obligations, and guaranteeing adherence to pertinent regulations.

is a prominent offering agency. Being an expert supplying company, we have actually qualified experts to handle all the related elements. Our specialists have an extensive understanding of the taxes standards and can aid you adhere to very same.

The Basic Principles Of Baron Accounting

Why do we have taxes? The simple response is that, up until somebody develops a better concept, taxation is the only sensible ways of elevating the revenue to fund government spending on the items and services that a lot of us need (ATO Online Tax Filing). Setting up a reliable and fair tax obligation system is, however, far from straightforward, specifically for creating countries that wish to come to be integrated in the international economic situation

Developing nations deal with powerful obstacles when they try to establish reliable tax systems. The base for a revenue tax obligation is consequently hard to compute.

4th, revenue often tends to be erratically dispersed within establishing nations. Although lifting tax incomes in this scenario preferably requires the rich to be exhausted much more heavily than the poor, the financial and political power of abundant taxpayers commonly enables them to stop financial reforms that would increase their tax obligation problems.

Jenna Von Oy Then & Now!

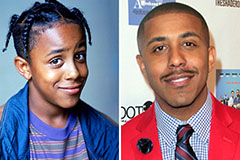

Jenna Von Oy Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!